Improving money management for Americans

The mission

Credit Human, a credit union based in San Antonio, wanted to add a digital experience to complement their financial services and serve their members well.

Many of their members are low- and middle income (LMI), and they were interested in using an app as an opportunity to improve the financial wellbeing of these members.

The approach

We started by learning about Credit Human’s LMI members and their spending and savings behaviours. From there, we convened staff and members to tell stories of financial change, share barriers they face, and come up with ideas that might address their challenges.

More insights and ideas emerged through co-creation and prototype testing to help us prioritize features of the app, touchpoints of the app experience, and key design principles.

The insights

-

The known

LMI individuals make unwise spending decisions that continually sets them back financially.

The unknown we uncovered

LMI individuals think about their money and their spending all the time. So often, in fact, that it does more harm than good. The cognitive overload that is caused by living in scarcity leaves them with less time, less energy, and less willpower to make good decisions.

“There are so many things on my mind and so little time that I can’t make the best-informed spending decisions. Because I don’t have a lot of money, making an unwise spending decision could cause a lot of trouble that’s hard to escape.”

-

The known

LMI individuals get into a cycle of debt (especially with payday lenders) when emergencies or unexpected costs arise.

The unknown we uncovered

Many LMI individuals live close to financial disaster, where a minor problem, like a Lego-clogged toilet, could be the tipping point into debt.

Despite wanting to be better prepared for unexpected expenses, LMI individuals find it difficult to put aside money.

Car repairs, medical checkups, and special occasions seem to come so infrequently that they are easily put on hold and dealt with only when they happen.

“My world is rocky and unpredictable, but I’m not prepared for the times I will have less. When the unexpected income loss or bill hike hits, I find myself trying to dig out of financial trouble.”

-

The known

LMI individuals don’t save money.

The unknown we uncovered

LMI individuals know they should save, but they struggle to because 1) they feast and fast — using moments of extra cash to spend, rather than save, and 2) they believe that they cannot “afford” to save, since they will need the money sooner or later.

“I live paycheck to paycheck, and although I know I should save and I want to save, I feel like I can’t. I don’t know how to start saving. Without savings, I have little security and no room for aspirations.”

The action

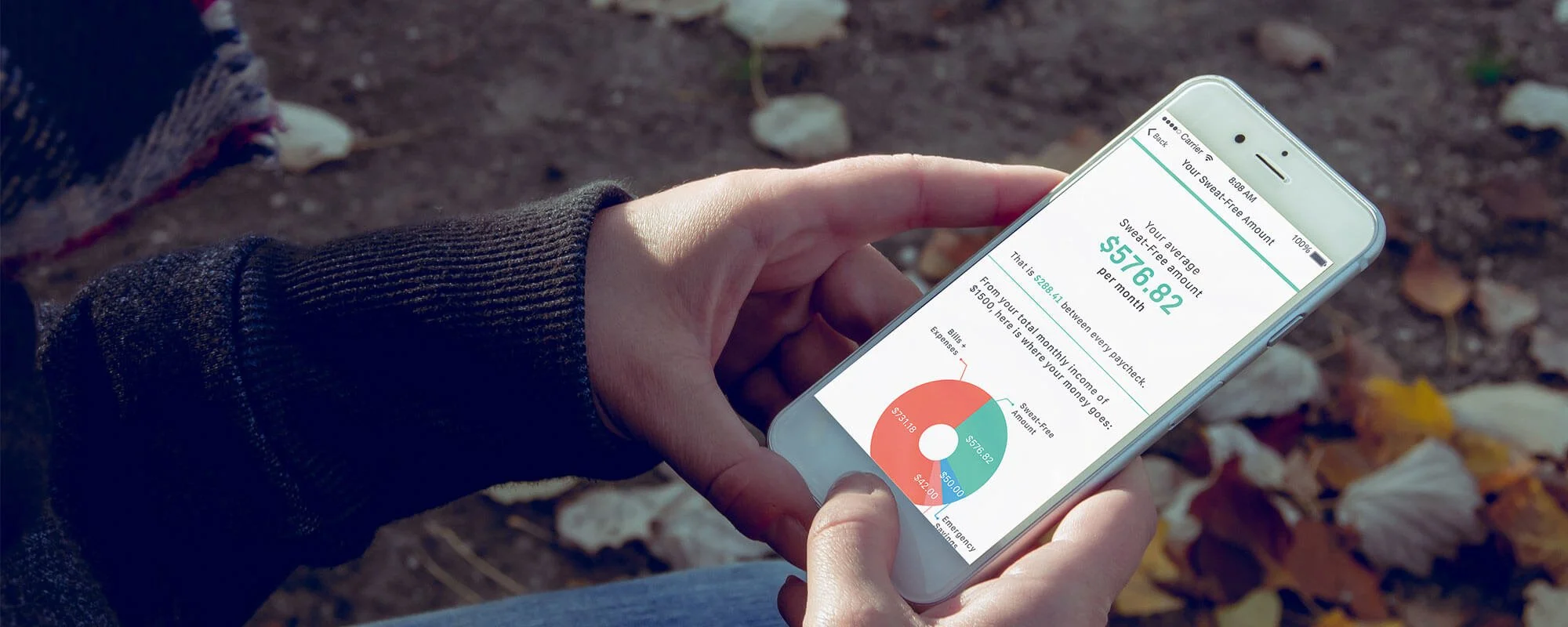

We landed on the key feature of the app called the Sweat-Free amount, which saves members from the cognitive load when making day-to-day purchase decisions. This amount takes into consideration a member’s income, regular bills, self-selected bill ‘buffer’, and self-selected savings amount — and computes a monthly amount that a member can spend ‘sweat-free’.

The Sweat-Free amount feature was just one part of the final design. We made sure to consider the full app experience by testing and designing details, from app awareness to set up to ongoing use.

Finally, we shared a core set of design principles for Credit Human to serve its members well, whether through the app or through its services.